Why Your Business Needs an ESG Reporting Strategy?

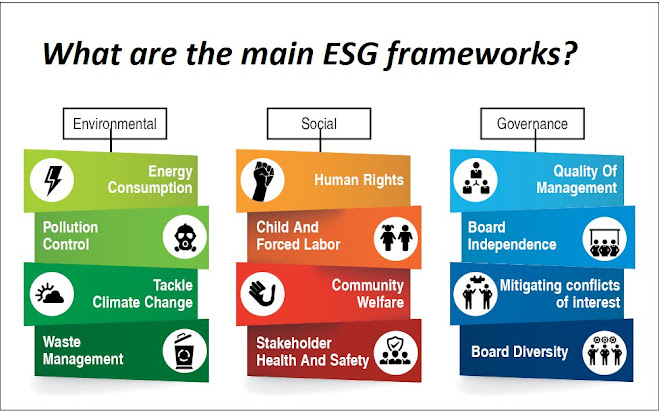

An Environmental, Social, and Governance (ESG) reporting strategy is becoming increasingly important for businesses due to growing stakeholder interest and demand for transparency and accountability. ESG reporting provides information on a company's performance and practices in areas such as sustainability, labor and human rights, and ethical behavior, which can impact both its reputation and financial performance.

Adopting an ESG reporting strategy can demonstrate a company's commitment to responsible business practices, help attract investment, and improve risk management. Additionally, regulatory requirements and investor expectations for ESG reporting are growing globally, making it increasingly important for businesses to have a comprehensive ESG reporting strategy in place.

Why is ESG reporting important for companies?

ESG reporting is important for companies for several reasons:

- Stakeholder demand: Investors, customers, and other stakeholders are increasingly interested in a company's ESG performance and practices, and ESG reporting provides a way to transparently communicate this information.

- Reputation and brand image: Companies that demonstrate a commitment to sustainability, ethics, and social responsibility through ESG reporting can improve their reputation and brand image.

- Financial performance: ESG factors can have a material impact on a company's financial performance, and ESG Investing can provide insight into a company's exposure to these risks and opportunities.

- Risk management: ESG reporting can help companies identify, monitor, and manage ESG risks, which can improve risk management and resilience.

- Regulation and compliance: ESG reporting requirements are becoming more prevalent globally, making it important for companies to have a comprehensive ESG reporting strategy to meet regulatory requirements and investor expectations.

Overall, ESG reporting is a crucial aspect of corporate responsibility and sustainability, and companies that prioritize ESG reporting can demonstrate their commitment to responsible business practices, attract investment, and improve risk management.

Sustainability & ESG Reporting

Sustainability and ESG reporting are related concepts that intersect in the corporate world. Sustainability refers to the ability of a company to meet the needs of the present without compromising the ability of future generations to meet their own needs. This encompasses economic, social, and environmental considerations.

ESG reporting, on the other hand, is a method of disclosing information about a company's Environmental, Social, and Governance (ESG) performance and practices to stakeholders. ESG reporting in India provides information on a company's impact on the environment, labor practices, human rights, and ethical behavior, among other factors.

Sustainability and ESG reporting are important because they help companies understand and manage their impact on the world and improve their reputation, financial performance, and risk management. Companies that prioritize sustainability and ESG reporting can demonstrate their commitment to responsible business practices and attract investment from stakeholders who prioritize sustainability and responsible investing.

Why is ESG suddenly important?

ESG has become increasingly important in recent years due to a combination of factors, including:

- Growing stakeholder interest: Investors, customers, employees, and other stakeholders are increasingly interested in a company's ESG performance and practices, and are looking for information on how companies are addressing sustainability and social issues.

- Financial performance: Research has shown that companies with strong ESG practices tend to outperform their peers in the long term and are better able to manage risks and navigate challenges.

- Regulation and disclosure requirements: Governments and regulators around the world are increasingly requiring companies to disclose ESG and sustainability information, and investors are expecting companies to provide ESG disclosure in order to make informed investment decisions.

- Climate change and sustainability: Climate change and other environmental issues have become more pressing, and stakeholders are demanding that companies take action to reduce their carbon footprint and mitigate environmental risks.

- Social issues: Issues such as human rights, labor practices, and diversity and inclusion have gained more attention in recent years, and stakeholders are demanding that companies address these issues in a responsible and transparent manner.

Overall, ESG has become important due to a growing recognition of the material impact that ESG factors can have on a company's reputation, financial performance, and risk management, and the growing demand from stakeholders for information on ESG practices and performance.

12 Ways To Drive Better ESG Reporting

Here are 12 ways companies can drive better ESG reporting:

- Set clear ESG objectives: Define clear and measurable ESG objectives that align with the company's strategy and values.

- Engage with stakeholders: Engage with stakeholders, including investors, customers, and employees, to understand their ESG expectations and concerns.

- Integrate ESG into business operations: Integrate ESG considerations into business operations and decision-making processes.

- Establish an ESG reporting framework: Establish a robust ESG reporting framework that includes data collection, data analysis, and reporting processes.

- Use relevant ESG reporting standards: Use relevant ESG reporting standards, such as the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB), to ensure consistency and comparability in ESG reporting.

- Assign ESG responsibility: Assign clear ESG reporting responsibility to an individual or team within the company.

- Collect high-quality data: Collect high-quality ESG data from across the organization and ensure data accuracy and completeness.

- Publish transparent and comprehensive ESG reports: Publish transparent and comprehensive ESG reports that provide meaningful information on ESG performance and practices.

- Engage with investors: Engage with investors to understand their ESG expectations and respond to their ESG-related questions and concerns.

- Continuously improve ESG reporting: Continuously review and improve ESG reporting processes and practices to ensure they remain relevant and effective.

- Use technology: Use technology, such as ESG reporting software, to streamline data collection and reporting processes.

- Collaborate with peers: Collaborate with peers and industry organizations to share best practices and improve ESG reporting standards and practices.

Overall, driving a better ESG framework requires a commitment to transparency, accountability, and continuous improvement. By following these 12 steps, companies can enhance their ESG reporting and demonstrate their commitment to responsible business practices.

Read more This Blog:- Why ESG environmental, social, and governance is important in business?

Comments

Post a Comment